Determining roi on investment property

As a most basic example Bob wants to calculate the ROI on his sheep farming operation. Gain from Investment - Cost of Investment.

Calculating Returns For A Rental Property Xelplus Leila Gharani

Follow Property Returns guide to learn the importance of determining ROI on Investment Property when it comes to your portfolio.

. Our new whitepaper aims to educate investors on the potential benefits and risks. Find the best investor-friendly agent for your next property investment. 10200 50000 0204 or 20 percent.

Now that you have your numbers you can calculate the ROI. This means that we have an annual return of 501684 41807 x 12 months. To get your annual income from these figures youll subtract your earnings for the year from expenses.

Your rental propertys ROI is 197. Finally lets calculate your total return on investment after 10 years of ownership. 11000 7068 7068 55.

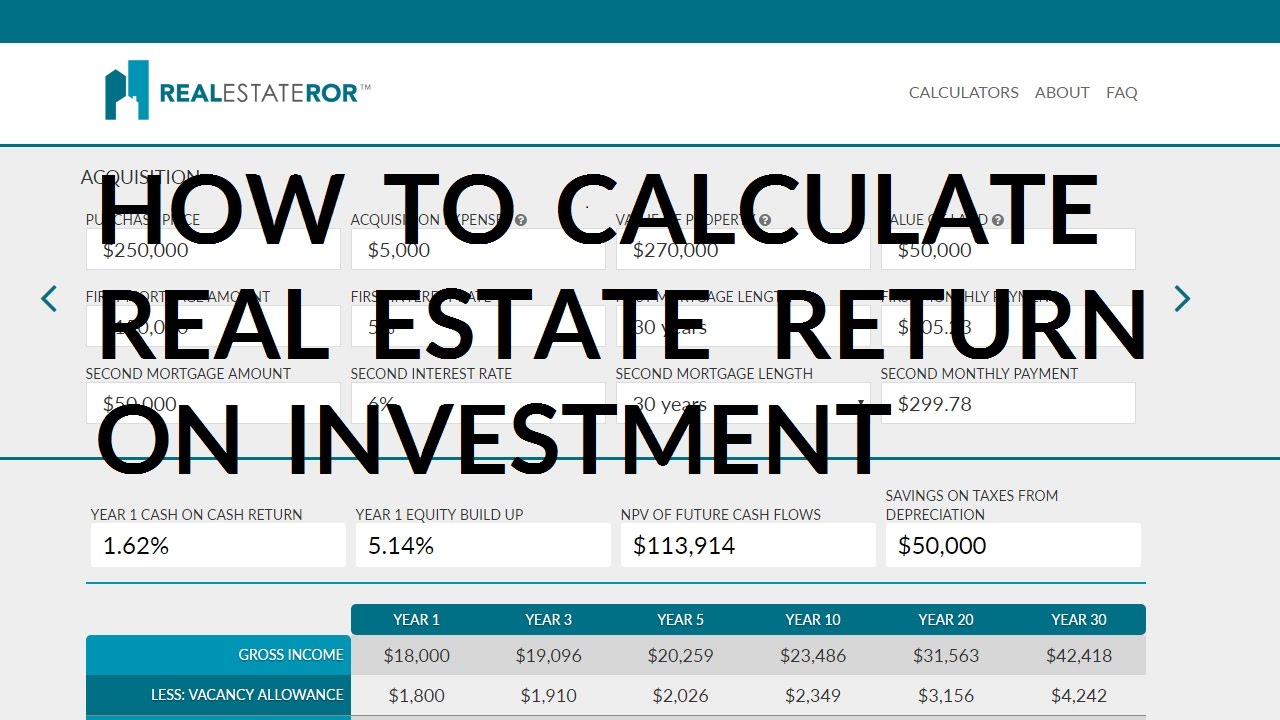

ROI on a real estate rental property is calculated using the following formula. If the property is bonded the profitability is. Income expenses expenses ROI.

Ad View Compare Current Investment Property Loan Rates. ROI 6504 33000 0197. Follow Property Returns guide to learn the importance of determining ROI on Investment Property when it comes to your portfolio.

Cap Rate 7600110000 x 100 69. Say you purchase a rental property for 50000 and the total profits you gained sum up to 80000. With a monthly cashflow of 542 2000 rent - 1458 mortgage payment your annual cash return.

Property Can Be An Excellent Investment. Get Instantly Matched With Your Ideal Lender. You can invest in real estate using all cash or by financing the property.

If your rental income is 2000 a month that equals 24000 annually. Real property can be most properties. Divide the annual return R96 000 R30 900 R126 900 by the amount of the total investment R1 03 million ROI R126 900 R103 million 0123 or 123.

Expenses such as taxes and utilities at the end of the year totaled 1800 150 per month. Calculate Understand Your Potential Returns. Ad AARPs Calculator is Designed to Examine.

Depending on the type of rental property investors need a certain level of expertise and knowledge to profit from their ventures. While this is the simplest method of calculating the return on investment its not always reliable. ROI is 123.

Rental property investment refers to the investment that involves real estate and its purchase followed by the holding leasing and selling of it. Apply Today Save Money. Once weve calculated our expenses its time to determine our ROI.

Ad AARPs Calculator Is Designed To Examine The Potential Return From An Investment Property. From the beginning until the present he invested a total of 50000 into the project and his total profits to date sum up to 70000. Compare Now Find The Lowest Rate.

Thus your return on investment is 60. Sale Proceeds Sale Price Loan Balance Closing Costs 161270 63027 4838 93405. ROI 19200 220000 00872 X 100 872.

12000 1800 10200. To calculate the propertys ROI. Now you have your rental property return on investment.

Ad BiggerPockets connects property investors with qualified real estate agents in minutes. Skip to content 1300 829 221. Recall that the ROI formula is.

The basic formula for ROI is. Now in order to calculate the propertys ROI were going to divide the annual return by our original out-of-pocket expenses the downpayment of. Lets look at the ROI for a cash purchase and a financed purchase using our 100000 in capital.

ROI Gain from Investment Cost of Investment Cost of Investment. ROI Sale Proceeds Cumulative Cash Flow Total Invested Cash Total Invested Cash 93405 37290 37000 37000 253. You now know how to calculate ROI for a rental property with repair and remodeling costs.

To calculate the rental propertys ROI. To get your annual income from these figures youll subtract your earnings for the. ROI Gain on investment Cost of investment Cost of investment.

With a monthly cashflow of 542 2000 rent - 1458 mortgage payment your annual cash return would be 6504. Ad Learn about CRE from a well-capitalized and reliable manager with a 38 year track record. Your ROI 872.

Thus your ROI would be. Divide the total annual return 19200 by the amount of the total investment 220000. Now to calculate the rental propertys ROI follow the previous cap rate formula and divide the annual return 7600 by the total investment you initially made 110000.

Fo rour residential property at 237 Rental Property Drive our calculation will be.

Calculating Returns For A Rental Property Xelplus Leila Gharani

What Is A Good Return On Investment For Rental Properties Mashvisor

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

How To Calculate Roi On Rental Property Rapid Property Connect

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

How To Calculate Roi On Residential Rental Property

Rental Property Calculator Most Accurate Forecast

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

Roi In Real Estate How To Calculate Roi On Property 99acres

How To Calculate Roi On Spanish Rental Property

How To Calculate Roi On Rental Property Real Estate Skills

How Do You Calculate Return On Investment On Rental Property

How To Calculate Roi On Spanish Rental Property

How To Calculate Roi On Rental Property Rapid Property Connect

Rental Property Cash On Cash Return Calculator Invest Four More

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Mortgage Payment Income Property

How To Calculate Rental Income The Right Way Smartmove